Safe Way to Grow Wealth During Uncertain Economic Times

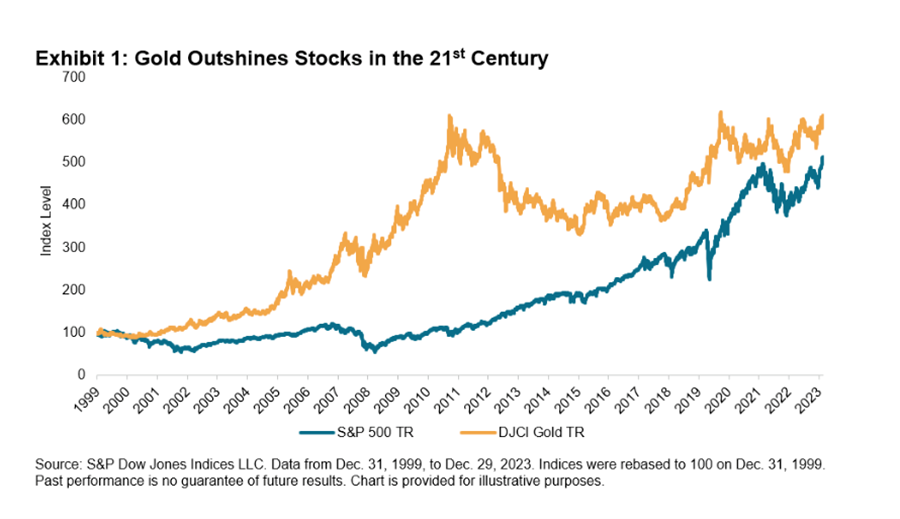

Since 2000, American investors have lost money to the dot-com bubble burst, the stock market crash, and the 2009 housing bubble burst. However, gold and silver remained relatively stable during those times. [3]More recently, gold was one of the best-performing assets of 2023, surpassing emerging market stocks, U.S. bonds, and commodities. Over the long term, from 1999 onward, gold has slightly outperformed stocks, with the Dow Jones Commodity Index Gold (DJCI) delivering a 7.8% return compared to 7% from the S&P 500. Bonds have underperformed, with an average return of just 4.1% since 1999. [4]

Gold also often offers better risk-adjusted returns than equities, making it a reliable hedge against economic volatility. In today’s uncertain times, investing in gold remains one of the safest ways to safeguard and grow your wealth.

Rising Gold and Silver Prices

Historically, the stock market was the go-to option for high, short-term profit gains. But stocks have become increasingly volatile and unpredictable in the past decade. From 2005 to 2024, gold prices increased by 597.14%, while the DJIA (Dow Jones Industrial Average) rose by only 339.58%. In October 2024, the price of gold reached a historic high of $2,788.54 per ounce. Buying gold may offer a fast-growing, long-term investment, without the volatility of the stock market. [5] [6]The price of silver has almost doubled in the past five years. In 2019, silver was $15.50 per ounce. Silver price has seen significant movement in 2024, breaking through the $30 mark earlier that year. As of September 2024, silver prices reached a high of $32.33 per ounce, holding steady in the $30 range as of early fall. The metal has gained momentum, driven by factors such as strong industrial demand, particularly from emerging technologies like solar panels and electric vehicles, alongside the silver market's continued supply deficit. [7]

Hedge Against Inflation

Precious metals are commodities with intrinsic value which guarantee demand regardless of the prevailing economic situation. In 2021, governments increased spending to jump-start their economies. Gold keeps up with the money supply but performs better amid high inflation. Gold prices increase by 15% on average when inflation is higher than 3%.[8]Unlike other investments, no one can build or print more precious metals and saturate the market. Banks can invest more in the real estate market, increase supply, and devalue your property investment within a few months. When you invest in gold, you don’t have to worry about market saturation and asset devaluation. Increased demand for gold generally leads to higher prices.

Central Banks Are Increasing Gold Reserves. Why You Should Too.

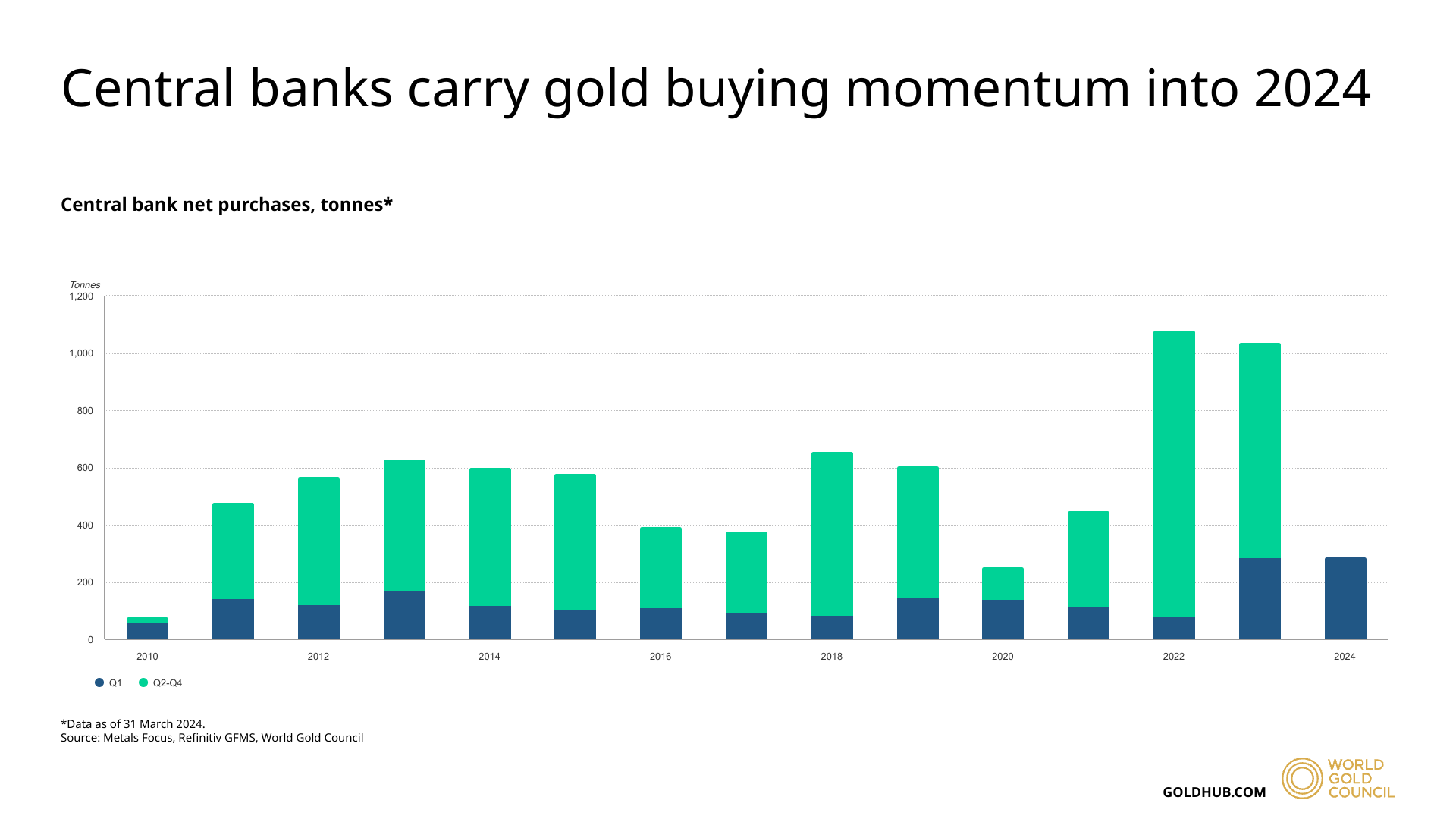

Central banks have been increasing their gold reserves at a record pace, with net purchases totaling 290 tons in the first quarter of 2024, setting the highest Q1 total since data collection began in 2000. This marks the continuation of a trend that has seen central banks intensify their gold buying, with countries like China, India, and Turkey leading the charge. China, for instance, added 27 tons to its reserves, continuing its streak of monthly gold increases, while Turkey bought 30 tons, marking its tenth consecutive month of purchases. These actions highlight a broader global pattern, especially among emerging markets, where gold is seen as a safe-haven asset. The strong demand from central banks has been a key factor in the recent rise in gold prices, which are driven by the ongoing diversification away from the U.S. dollar and the desire to bolster reserves with a tangible, stable asset. [9]

Central banks are buying gold because it offers several advantages in times of economic uncertainty. As a tangible asset, gold provides a hedge against inflation, currency depreciation, and geopolitical risks. With inflation rising globally and the strength of the U.S. dollar creating volatility, central banks are seeking to protect their reserves by increasing their holdings of gold. For you, buying gold now can offer similar protection. Gold can preserve and even grow your wealth over time, particularly when fiat currencies lose purchasing power. Whether you're concerned about inflation, economic instability, or simply looking to diversify your investment portfolio, gold remains a reliable and proven store of value.

For more information, please see our why precious metals page. Goldline has over 60 years of experience in the precious metals sector. You can rely on Goldline to buy gold, silver, and platinum coins and/or bars. To diversify your retirement portfolio, contact us today!

This information does not constitute investment advice, is general in nature, and provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. All investments, including precious metals, involve some degree of risk and are affected by numerous economic and geo-political factors, all of which are beyond Goldline’s control. You, and not Goldline, are responsible for such risk, including, without limitation, market volatility and the inability to liquidate the products at an acceptable price, or at all. For additional information, see our online Terms of Service.

References

1. Hulbert, M., Opinion: What a falling dollar could do to the stock market, Market Watch, 02/21/2020.

2. Ross, S., What It Would Take for the U.S. Dollar To Collapse, Investopedia, 10/23/2024.

3. The Investopedia Team, What Is a Housing Bubble?, Investopedia, 03/15/2024.

4. Maharrey, M., Gold has outperformed the S&P in the 21st century, FXStreet, 01/09/2024.

5. Pistilli, M., What Was the Highest Price for Gold?, Investing News Network, 10/25/2024.

6. Dow Jones - DJIA - 100 Year Historical Chart, Macrotrends, 11/14/2024.

7. Pistilli, M., Could the Silver Price Really Hit $100 per Ounce?, Investing News Network, 09/17/2024.

8. Gold Outlook 2021, World Gold Council, 01/14/2021.

9. Gold Demand Trends Q1 2024, World Gold Council, 04/30/2024.

Since historical time, precious metals like Gold, and Silver have been a part of the economic aspects of life. Gold and Silver are synonymous with wealth generation and wellbeing, which is why they adorned the crowns of kings and queens.